Is Real Diamond Jewelry a Good Investment? Facts, Myths & Expert Insights

Real diamond jewelry investment overview

A Luxury Question Worth Billions: Investment or Indulgence?

For centuries, diamonds have symbolized wealth, permanence, and power. From royal treasuries to modern engagement rings, real diamond jewelry has always occupied a unique position at the intersection of luxury and finance. Yet a crucial question continues to spark debate among buyers and collectors alike: Is real diamond jewelry a good investment?

Unlike stocks or real estate, diamonds are tangible, portable, and emotionally charged assets. They can be worn, gifted, and passed down through generations. But does beauty translate into financial growth? This comprehensive guide cuts through myths, marketing claims, and half-truths to reveal expert-backed insights into diamond investment potential.

Table of Contents

- What Does Investing in Diamond Jewelry Mean?

- Historical Performance of Diamonds

- Facts vs Myths About Diamond Investment

- What Really Drives Diamond Value?

- Jewelry vs Loose Diamonds

- Expected Returns & Time Horizon

- Real-World Case Studies

- Risks & Limitations

- Step-by-Step Diamond Investment Guide

- Frequently Asked Questions

What Does Investing in Real Diamond Jewelry Mean?

Investing in real diamond jewelry differs fundamentally from traditional financial instruments. It means allocating capital into high-quality natural diamonds—often set in fine jewelry—with the expectation of preserving value and potentially achieving appreciation over time.

Investment vs Consumption

- Consumption purchase: Buying for beauty, fashion, or emotional reasons

- Investment purchase: Buying with rarity, resale, and long-term value in mind

Many purchases fall somewhere in between. A diamond engagement ring, for example, may not outperform equities, but it can retain value while serving a deeply personal purpose.

Historical Performance of Diamonds as Assets

Historically, diamonds have acted more as a store of value than a high-growth investment. Unlike gold, diamonds do not trade on open exchanges, which makes pricing less transparent but also less volatile.

Long-Term Price Trends

High-quality natural diamonds have generally appreciated slowly over decades, particularly rare stones such as:

- Fancy color diamonds

- Large-carat flawless diamonds

- Antique and signed jewelry

Historical diamond market performance chart

Diamond Investment: Facts vs Common Myths

Myth 1: All Diamonds Increase in Value

Reality: Only a small percentage of diamonds appreciate meaningfully. Commercial-grade jewelry often resells below retail.

Myth 2: Diamonds Are Highly Liquid

Fact: Liquidity exists, but resale requires time, expertise, and access to the right buyers.

Myth 3: Jewelry Always Loses Value

Fact: Exceptional pieces, especially from reputable sources like Fancy Diamond Jewels, can retain or increase value.

What Really Drives Diamond Value?

The 4Cs Still Matter—But Not Equally

| Factor | Investment Importance |

|---|---|

| Carat | Very High |

| Color | High (especially fancy colors) |

| Clarity | Medium to High |

| Cut | High |

Additional Investment Drivers

- Natural origin (not lab-grown)

- Certification and provenance

- Rarity and market demand

Diamond Jewelry vs Loose Diamonds: Which Is Better?

Loose Diamonds

- Higher liquidity

- Lower markup

- Pure investment focus

Diamond Jewelry

- Wearable value

- Design and craftsmanship premium

- Emotional and heirloom worth

For many buyers, jewelry offers a balanced approach—financial preservation combined with lifestyle enjoyment.

Expected Returns: What Can You Realistically Expect?

Real diamond jewelry should be viewed as a long-term, low-yield asset. Annual appreciation may range from 1%–4% for high-quality stones, with spikes possible for rare categories.

Comparison with Other Assets

| Asset | Volatility | Liquidity | Emotional Value |

|---|---|---|---|

| Stocks | High | High | Low |

| Gold | Medium | High | Low |

| Diamond Jewelry | Low | Medium | Very High |

Case Studies: When Diamond Jewelry Paid Off

Case Study 1: Fancy Color Diamond Ring

A rare natural fancy color diamond ring purchased 15 years ago retained its value and later sold at a premium due to increased global demand for colored stones.

Case Study 2: Heirloom Diamond Necklace

An antique diamond necklace gained value not just from its stones, but from craftsmanship and historical appeal.

Antique diamond jewelry heirloom example

Risks & Limitations of Diamond Investment

- Retail markups

- Resale spreads

- Market opacity

- Insurance and storage costs

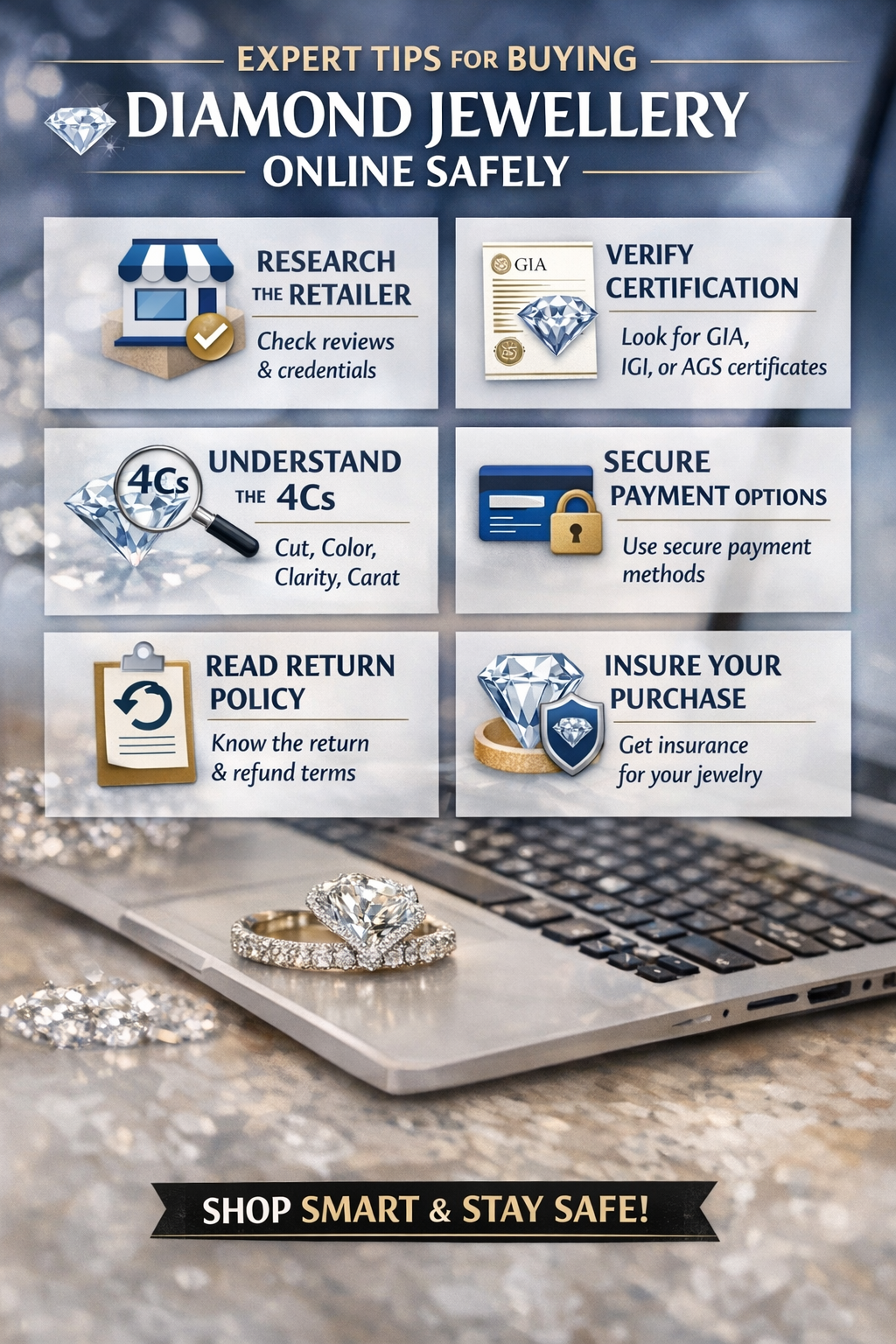

Step-by-Step Guide: How to Invest in Real Diamond Jewelry

Step 1: Define Your Objective

Decide whether your priority is preservation, appreciation, or emotional value.

Step 2: Choose Natural, Certified Diamonds

Natural diamonds with trusted certification are essential for investment credibility.

Step 3: Buy from Established Jewelers

Reputable sources like Fancy Diamond Jewels ensure transparency and quality.

Step 4: Hold Long-Term

Diamond investment rewards patience rather than short-term trading.

Explore Investment-Grade Diamond JewelryFrequently Asked Questions

Is real diamond jewelry better than gold as an investment?

Diamonds offer emotional and rarity value, while gold offers higher liquidity.

Do lab-grown diamonds hold investment value?

No, lab-grown diamonds lack long-term scarcity.

How long should I hold diamond jewelry?

Ideally 10–20 years for meaningful value preservation.

Are engagement rings a good investment?

They are primarily emotional purchases but can retain value if high quality.

What diamonds appreciate the most?

Rare fancy color and large-carat natural diamonds.

Is resale difficult?

Resale requires the right channel and realistic pricing expectations.

Does brand matter?

Yes, provenance and seller reputation influence trust and resale.

Should I insure investment jewelry?

Yes, insurance protects against loss and damage.

Can diamonds hedge inflation?

They can help preserve value but are not perfect inflation hedges.

Is diamond jewelry suitable for beginners?

Yes, when guided by education and reputable sellers.

Final Verdict: Is Real Diamond Jewelry a Good Investment?

Real diamond jewelry is best viewed as a luxury asset—one that blends financial stability, emotional significance, and timeless beauty. While it may not outperform aggressive financial instruments, it offers something few investments can: tangible elegance that endures across generations.

1 commentaire

Great article! I think one key point for anyone considering diamonds is to always look for GIA certified diamonds — that certification gives you real info on the 4 Cs and helps protect you from overpaying for quality you can’t see. That said, many experts point out that diamond jewellery often doesn’t appreciate like traditional financial assets because of retail markups and resale challenges, so it’s usually best enjoyed for its beauty and personal meaning rather than pure investment value. Some custom designers (like Karat Kraft) emphasize quality and transparency over hype, which I always appreciate when choosing pieces I’ll wear for years.

Karat Kraft

Laisser un commentaire

Ce site est protégé par hCaptcha, et la Politique de confidentialité et les Conditions de service de hCaptcha s’appliquent.